Thank You for Your Support!

Your loving contribution makes all the difference in transforming the lives of children, women and elderly in the marginalized communities we serve.

Ways donor support impacted change

this year:

1,908

Children

Growing through our holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,775

Adolescent Girls

Participating in awareness, mentorship and confidence building activities, preventing school dropouts and early marriage.

1,380

Families

Financially secured through skill development, livelihood support and small business loans.

2,060

Women

Supported and empowered through programs in upskilling, financial literacy, health and awareness.

Less than 2% of your gift goes to Manav Sadhna’s administrative costs.

If you are interested in adopting one of our community centers or sponsoring a project, please contact us at info@manavsadhna.org.

“It is not how much we give,

but how much love we put into giving.”

-Mother Teresa

Manav Sadhna is registered under FCRA (Foreign Contribution Regulation Act-2010). Purpose Code: P 1303.

All donations made by US citizens to Manav Sadhna, USA can avail 100% Tax Exemption under 501(c)(3).

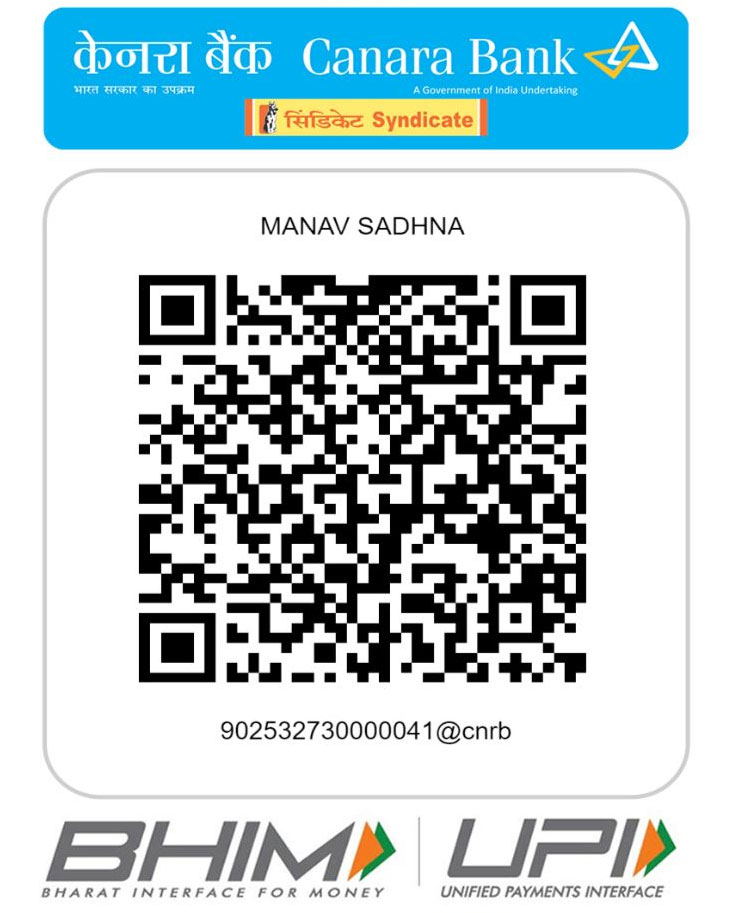

By QR Code

For Indian Passport Holders

Ahmedabad-380027.

For Foreign Passport Holders

Indian Citizen

____

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Thank You for Your Support

Ways your support impacted change this year

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,775

Adolescent Girls

Participating in awareness, mentorship and confidence building activities, preventing school dropouts and early marriage.

1,380

Families

Financially secured through skill development, livelihood support and small business loans.

2,060

Women

Supported and empowered through programs in upskilling, financial literacy, health and awareness.

610

Elderly and vulnerable

Protected from hunger through Annadaan, our monthly food support program.

11,805

Beneficiaries

Fed through our daily nutrition program.

39,320

Community Members

Benefited from our health treatment programs and awareness camps.

5,010

Infants

nurtured through our early-child development programme at Anganwadi centers.

Manav Sadhna is registered under FCRA (Foreign Contribution Regulation Act-2010). Purpose Code: P 1303

All donations made by US citizens to Manav Sadhna, USA can avail 100% Tax Exemption under 501(c)(3).

Less than 2% of your gift goes to Manav Sadhna’s administrative costs.

If you are interested in adopting one of our community centers or sponsoring a project, please contact us at info@manavsadhna.org.

“It is not how much we give,

but how much love we put into giving.”

-Mother Teresa

Indian Citizen

____

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Option 1

Outside of India (US, UK, etc.)

To contribute from Indian Account, please donate here.

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please Click Here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Indian Citizen

____

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Option 2

Outside of India (US, UK, etc.)

Indian Citizen

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please Click Here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Thank You for Your Support

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

Option 3

Outside of India (US, UK, etc.)

Donate Today

and Make a Difference...

Thank You for Your Support

Ways your support impacted change this year

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

Indian Citizen

Donate Today

and Make a Difference...

Thank You for Your Support

Ways your support impacted change this year

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please Click Here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Indian Citizen

____

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please click here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Donate Today

and Make a Difference...

Thank You for Your Support

Ways your support impacted change this year

1,908

Children

Thriving through 1st-10th holistic education program (values-learning, academic classes, sports, arts, leadership growth and a warm meal, daily).

1,775

Adolescent Girls

Participating in awareness, mentorship and confidence building activities, preventing school dropouts and early marriage.

1,380

Families

Financially secured through skill development, livelihood support and small business loans.

2,060

Women

Supported and empowered through programs in upskilling, financial literacy, health and awareness.

610

Elderly and vulnerable

Protected from hunger through Annadaan, our monthly food support program.

11,805

Beneficiaries

Fed through our daily nutrition program.

39,320

Community Members

Benefited from our health treatment programs and awareness camps.

5,010

Infants

nurtured through our early-child development programme at Anganwadi centers.

Donate here if you are donating from outside of India (ie. USA, UK, Australia, etc.) through a non-Indian bank account or foreign-issued credit or debit card.

Manav Sadhna is registered under FCRA (Foreign Contribution Regulation Act-2010). Purpose Code: P 1303

All donations made by US citizens to Manav Sadhna, USA can avail 100% Tax Exemption under 501(c)(3).

Donate here if you are an Indian Citizen donating in rupees through an Indian bank account or India-issued credit or debit card.

If you are an Indian citizen wanting to donate through a foreign bank account or foreign-issued credit or debit card, please Click Here.

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.

Less than 2% of your gift goes to Manav Sadhna’s administrative costs.

If you are interested in adopting one of our community centers or sponsoring a project, please contact us at info@manavsadhna.org.

“It is not how much we give,

but how much love we put into giving.”

-Mother Teresa

All donations made by Indian citizens to Manav Sadhna, India are 50% Tax Exempt under Section 80(G) of Income Tax Act-1961.

As per India’s guidelines, to share the 80(G) tax exemption certificate it is mandatory to note the donor’s address and PAN number.